© Copyright Atlanta Coin Expositions, 2008-2025. All Rights Reserved.

Several of the links on the pages within this web site go to affiliate vendors.

A vendor affiliation can mean a small monetary compensation to the web site owner at no additional cost to you.

Several of the links on the pages within this web site go to affiliate vendors.

A vendor affiliation can mean a small monetary compensation to the web site owner at no additional cost to you.

Coin Show

Information

Shop

General

Coin Show - Monthly Notes from December 2017

Next Monthly Coin Show

Here's hoping your Holiday Season is/was joyful, safe and healthy, and may your New Year be bright and prosperous.

Mark your calendars to join us for the first monthly coin show of 2018 on Sunday, January 14, in the Joe Mack Wilson ballroom.

The dealers will again pack the coin show's bourse with their displays of coins, currency, bullion and other collectibles.

Mark your calendars to join us for the first monthly coin show of 2018 on Sunday, January 14, in the Joe Mack Wilson ballroom.

The dealers will again pack the coin show's bourse with their displays of coins, currency, bullion and other collectibles.

Visitors to the December 2017 monthly Greater Atlanta Coin Show braved the weather and 10 inches of snow in the area to visit the last bourse of the year.

We appreciate all of the visitors, the dealers, our security and the hotel staff for all their efforts toward another successful, even though cold, monthly coin show. Our many thanks go to each and every one of you.

First, what about that weather. The meteorologists predicted two, maybe three, inches of snow for the area.

But the temperatures and atmospheric conditions kept the snow falling for over 24 hours with large, wet flakes that quickly became more than the predicted two to three inches.

With temperatures in the mid thirties on Saturday, some of the snow melted, however that night and early Sunday morning saw freezing temperatures in the low 20s and perhaps even lower.

Even so, most of the dealers arrived early, like they always do, to be ready for the visitors at 9 am.

Traveling up the hotel's entrance lane, people saw the broken trees in the parking lot and limbs on vehicles parked in the lot overnight.

Again, though, the weather and the fallen trees did not prevent the visitors coming to the show.

We appreciate all of the visitors, the dealers, our security and the hotel staff for all their efforts toward another successful, even though cold, monthly coin show. Our many thanks go to each and every one of you.

First, what about that weather. The meteorologists predicted two, maybe three, inches of snow for the area.

But the temperatures and atmospheric conditions kept the snow falling for over 24 hours with large, wet flakes that quickly became more than the predicted two to three inches.

With temperatures in the mid thirties on Saturday, some of the snow melted, however that night and early Sunday morning saw freezing temperatures in the low 20s and perhaps even lower.

Even so, most of the dealers arrived early, like they always do, to be ready for the visitors at 9 am.

Traveling up the hotel's entrance lane, people saw the broken trees in the parking lot and limbs on vehicles parked in the lot overnight.

Again, though, the weather and the fallen trees did not prevent the visitors coming to the show.

Of course, we did not have quite as many people visit the show as during previous December shows. That's to be expected with the weather conditions.

We had some dealers leave the Gallatin, Tennessee coin show on Saturday, near Nashville, and drive south to be ready for the show on Sunday. They commented that they saw the demarcation between no snow in the north and the depth of snow increasing as they journeyed southward.

We even had one dealer, as a visitor, drive from his home in Maryland to the Gallatin show in Tennessee, to Mississippi, back to our show in Marietta on his way back home. That's a coin show road warrior.

As for the hotel in December, they hosted several holiday events.

We had some dealers leave the Gallatin, Tennessee coin show on Saturday, near Nashville, and drive south to be ready for the show on Sunday. They commented that they saw the demarcation between no snow in the north and the depth of snow increasing as they journeyed southward.

We even had one dealer, as a visitor, drive from his home in Maryland to the Gallatin show in Tennessee, to Mississippi, back to our show in Marietta on his way back home. That's a coin show road warrior.

As for the hotel in December, they hosted several holiday events.

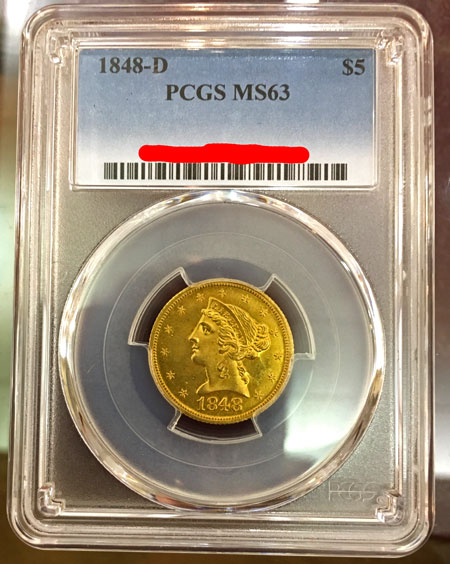

Half Eagle - 1848 Liberty Head

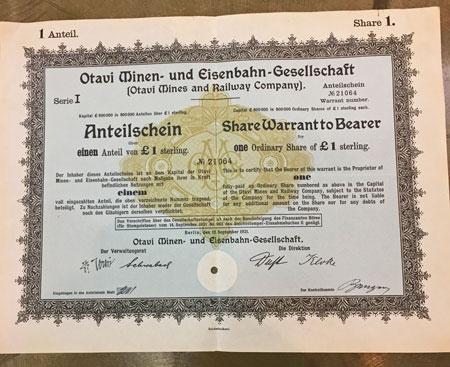

Otavi Mines and Railway Company

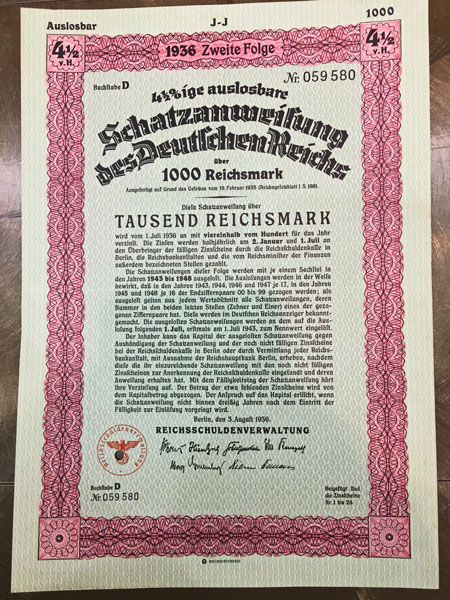

Treasury Note 1000 RM 1936 Third Reich, Berlin German Empire bond

Late afternoon as the coin show neared closing time, the hotel's crews began breaking the room down to set it up for a Home Depot party, with gifts even. We hope they had a good event.

Now, let's take a look at a few of the items seen on the bourse.

Now, let's take a look at a few of the items seen on the bourse.

The US Mint first made the gold half eagle coins, $5, in 1795. They produced the last ones in 1929.

In the early years with only one mint location, the Philadelphia Mint produced the gold half eagles from 1795 to 1837 with several designs and varieties.

In 1834, the Mint introduced the Classic Head design, and in 1838, the Charlotte and Dahlonega mint locations began their production of the $5 gold coins.

In 1839, they produced the Liberty Head, and over the next few years, the newer mint locations of New Orleans and San Francisco added to their production.

In 1866, the Mint introduced a variety to the Liberty Head design and in 1908, they changed the design to the Indian Head gold half eagle.

The half eagle coin at the show was an 1848 Liberty Head from the Dahlonega Mint.

In the early years with only one mint location, the Philadelphia Mint produced the gold half eagles from 1795 to 1837 with several designs and varieties.

In 1834, the Mint introduced the Classic Head design, and in 1838, the Charlotte and Dahlonega mint locations began their production of the $5 gold coins.

In 1839, they produced the Liberty Head, and over the next few years, the newer mint locations of New Orleans and San Francisco added to their production.

In 1866, the Mint introduced a variety to the Liberty Head design and in 1908, they changed the design to the Indian Head gold half eagle.

The half eagle coin at the show was an 1848 Liberty Head from the Dahlonega Mint.

The Professional Coin Grading Service graded this coin as a MS-63. Their web site estimates the survival rate across all grades at 175 and shows they have certified only three of this coin in this grade.

In addition, they note the following comments:

Doug Winter: "The 1848-D is often regarded as one of the more common Dahlonega half eagles. This is most definitely not the case as it is actually quite scarce in any grade and very rare in high grades.

"The 1848-D half eagle is a scarce and undervalued issue. Most grade Very Fine to Extremely Fine. Any coin grading About Uncirculated is rare and any About Uncirculated example with good eye appeal is very rare. In Mint State, the 1848-D half eagle is extremely rare."

David Akers (1975/88): "A few pieces graded uncirculated by the cataloguers showed up in my 337 catalogue survey, but none in the past decade. Even AU pieces have been conspicuously absent from most major sales.

In addition, they note the following comments:

Doug Winter: "The 1848-D is often regarded as one of the more common Dahlonega half eagles. This is most definitely not the case as it is actually quite scarce in any grade and very rare in high grades.

"The 1848-D half eagle is a scarce and undervalued issue. Most grade Very Fine to Extremely Fine. Any coin grading About Uncirculated is rare and any About Uncirculated example with good eye appeal is very rare. In Mint State, the 1848-D half eagle is extremely rare."

David Akers (1975/88): "A few pieces graded uncirculated by the cataloguers showed up in my 337 catalogue survey, but none in the past decade. Even AU pieces have been conspicuously absent from most major sales.

"The conclusion that this date is a rare one in all grades is unmistakable and above EF it must be considered a major rarity.

"As a date, it is considerably more rare than the 1843-1847 Dahlonega Mint coins, and it is approximately equal in overall rarity to the 1849-D and 1850-D that follow. Expect to find only Fine to EF specimens if looking for this date."

In summary, this coin is a rare and very nice example of a gold half eagle from the Dahlonega Mint.

"As a date, it is considerably more rare than the 1843-1847 Dahlonega Mint coins, and it is approximately equal in overall rarity to the 1849-D and 1850-D that follow. Expect to find only Fine to EF specimens if looking for this date."

In summary, this coin is a rare and very nice example of a gold half eagle from the Dahlonega Mint.

The next item on the bourse should interest those who like scripophily, which is the collection of old bond and share certificates as a pursuit or hobby.

Perhaps in a distant way, it could interest the ferroequinologists as well - the Iron Horse enthusiasts.

This particular document is a September 12, 1921 single share of the Otavi Mines and Railway Company known as OMEG for the Deutsche (German) name of Otavi Minen- und Eisenbahn-Gesellschaft.

Perhaps in a distant way, it could interest the ferroequinologists as well - the Iron Horse enthusiasts.

This particular document is a September 12, 1921 single share of the Otavi Mines and Railway Company known as OMEG for the Deutsche (German) name of Otavi Minen- und Eisenbahn-Gesellschaft.

Founded in April 1900 in Berlin, OMEG included railway and mining interests in German South West Africa (today's Namibia). The Disconto-Gesellschaft and the South West Africa Company were the major shareholders, however single shares were sold at £1 Sterling.

Initially, OMEG built a 600 mm narrow-gauge rail line 567 kilometres (352 mi) long from Swakopmund on the Atlantic coast to the mines of Tsumeb. Construction began in 1903 and reached Tsumeb three years later.

However, during World War I, German forces destroyed a portion of the 600 mm line.

In 1915, the South Africans constructed another narrow-gauge, this time 1067 mm, railroad over the destroyed route.

Initially, OMEG built a 600 mm narrow-gauge rail line 567 kilometres (352 mi) long from Swakopmund on the Atlantic coast to the mines of Tsumeb. Construction began in 1903 and reached Tsumeb three years later.

However, during World War I, German forces destroyed a portion of the 600 mm line.

In 1915, the South Africans constructed another narrow-gauge, this time 1067 mm, railroad over the destroyed route.

After the Germans left the area, the rail line re-instated service with freight transfer services between the two different gauges at Karabib.

The Otavi rail line was nationalized in 1923 and continued in service.

In 1961, the whole line was re-gauged to 1067mm and became part of the TranNamib railway.

This particular share reads in both Deutsch and English:

Capital £800,000 in 800,000 Ordinary Shares of £1 sterling each.

Share Warrant to Bearer for one Ordinary Share of £1 sterling

No. 21064

This is to certify that the Bearer of this warrant is the Proprietor of one fully-paid up Ordinary Share numbered as above in the Capital of the Otavi Mines and Railway Company, subject to the Statutes of the Company for the time being. The Bearer is not liable for any additional amount on the Share nor for any debts of the Company.

Signatures of the representatives of OMEG rested below the description and inside the certificate's border.

This document provides an interesting example of early 20th century history along with its value as a collectible stock share.

The Otavi rail line was nationalized in 1923 and continued in service.

In 1961, the whole line was re-gauged to 1067mm and became part of the TranNamib railway.

This particular share reads in both Deutsch and English:

Capital £800,000 in 800,000 Ordinary Shares of £1 sterling each.

Share Warrant to Bearer for one Ordinary Share of £1 sterling

No. 21064

This is to certify that the Bearer of this warrant is the Proprietor of one fully-paid up Ordinary Share numbered as above in the Capital of the Otavi Mines and Railway Company, subject to the Statutes of the Company for the time being. The Bearer is not liable for any additional amount on the Share nor for any debts of the Company.

Signatures of the representatives of OMEG rested below the description and inside the certificate's border.

This document provides an interesting example of early 20th century history along with its value as a collectible stock share.

The next item is another from Deutschland, however this one is fully in the Deutsch language. It is also from the Nazi era with a swastika in the middle of its seal.

Interestingly, German law (statutes §86 and $86a StGB) states "A historical and military item from the year 1933-1945 with a Third Reich emblem, is not to be used in any propagandistical way. It is strictly forbidden and a criminal offence."

However, this seal has been cancelled with a hole punched through the middle making the swastika not quite as offensive.

As noted on the Siegelmarke (seal), the Reichsschuldenverwaltung or Reich Debt Administration managed these treasury bonds.

From the German Wikipedia describing the Nazi era and post-war period:

"After the beginning of the National Socialist rule, the loan authorization law was transferred from the Reichstag to the Reich government in the course of the Enabling Act of 1933.

"Air raids destroyed most of the debt register files in 1945. In 1946, the debt administration was placed under the Allied Military Command.

Interestingly, German law (statutes §86 and $86a StGB) states "A historical and military item from the year 1933-1945 with a Third Reich emblem, is not to be used in any propagandistical way. It is strictly forbidden and a criminal offence."

However, this seal has been cancelled with a hole punched through the middle making the swastika not quite as offensive.

As noted on the Siegelmarke (seal), the Reichsschuldenverwaltung or Reich Debt Administration managed these treasury bonds.

From the German Wikipedia describing the Nazi era and post-war period:

"After the beginning of the National Socialist rule, the loan authorization law was transferred from the Reichstag to the Reich government in the course of the Enabling Act of 1933.

"Air raids destroyed most of the debt register files in 1945. In 1946, the debt administration was placed under the Allied Military Command.

"The Reich debt administration was renamed in March 1948 in 'administrative group for archives of the former imperial debt administration.' In July of the same year, a debt administration of the United Economic Area was established.

"This resulted in 1949, the federal debt administration. This was renamed in 2002 in Federal securities management. In August 2006, this finally merged into the German Finance Agency.

This particular Treasury bond was dated August 1936 and was to deliver 4.5 percent calculated in January and July.

These bonds came in a variety of denominations such as 100 RM, 500 RM, 1000 RM and 10,000 RM.

"This resulted in 1949, the federal debt administration. This was renamed in 2002 in Federal securities management. In August 2006, this finally merged into the German Finance Agency.

This particular Treasury bond was dated August 1936 and was to deliver 4.5 percent calculated in January and July.

These bonds came in a variety of denominations such as 100 RM, 500 RM, 1000 RM and 10,000 RM.

Though World War II did not officially begin until 1939, Germany participated in the Spanish Civil War between 1936 and 1939.

This bond probably supported the German war machine in that timeframe.

A simple piece of paper, artistically decorated, provides insights into the German financial history along with its war efforts.

This bond probably supported the German war machine in that timeframe.

A simple piece of paper, artistically decorated, provides insights into the German financial history along with its war efforts.