Today, the Large Cent Coin remembers one lady’s letter to a newspaper editor on November 4, 1816 concerning the need for rules of visiting.

Printed in the Alexandria [VA] Gazette, Commercial and Political newspaper of November 04, 1816:

=====

To the Editor of the Compiler.

Though it is not meet for a female to seek the public eye, and to shine in the newspapers, yet I am so overpowered by the importance of the subject, that I cannot forbear delivering a few ideas upon it.

You must know, Sir, that I have almost been annoyed to death by the trouble of receiving and returning fashionable visits—and so completely was l satisfied that the present laws upon this matter required amendment, that a very particular friend and myself put our heads together for the purpose of framing a new code, or The Rules of Visiting.

A few of these are as follows:

1st. Henceforth there are two days to be set apart in every week, for giving and receiving ladies’ visits—These shall be Mondays and Thursdays. On each of these days, from 10 o’clock to 3, every house and lady shall be ready for the reception of such ladies as may choose to call. No excuse shall be taken for finding the house out of order.

This rule is founded upon the known fact; that so many are sadly put to it to keep our houses and ourselves always in trim to see company—Lud, Mr. Compiler, what embarrassment have I felt from being caught en dishabille!

2nd. Should any stranger, who will leave town before the next levee day, wish to see a lady, let 6 hours notice always be given, to put everything to rights.

3rd. The whole system of cards be at once abolished—among the ladies of Richmond. If one lady calls, and does not find the lady of the house at once, the matter is to be explained at the first meeting, and no offense to be taken for not calling sooner.

4th. This rule is to be dispensed with in favor of all strangers, who may leave a card if the lady be not at home, to show who it was that called, and where he or she is to be found.

5th. On the levee days, every lady to be at home, and to see her guest — If she does not appear, it is to be considered that she wishes to drop the other’s acquaintance.

6th. As ladies will call less seldom than at present, they may stay a little longer but no lady is to stay one minute longer than she finds it agreeable to all sides.

7th. At these visits all forms to be abolished, except what may be required by civility, and good manners. No slander, no flattery, no smirking or ill nature, no arrogance or presumption to be tolerated.

8th. No lady to visit another, to pick up materials for abusing her afterwards, for none is to visit, who has not some slight esteem at least for the lady of the house.

9th. The restrictions as to the levee days to be binding only among ladies, who care very little about knowing each other, they are of course dispensed with among friends or near neighbors, who happen to be on good terms. These may enter a house at all seasons of the day.

Feeling, Sir, the want of some of these rules in one person, and believing that they would be very conducive to the comfort of polished society, l take the liberty of sending them for the consideration of your readers.

Yours, most modestly,

Lucretia MacTab

=====

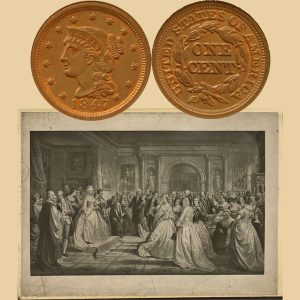

The Large Cent Coin shows with an artist’s image, circa 1861, of one of Lady Washington’s receptions.