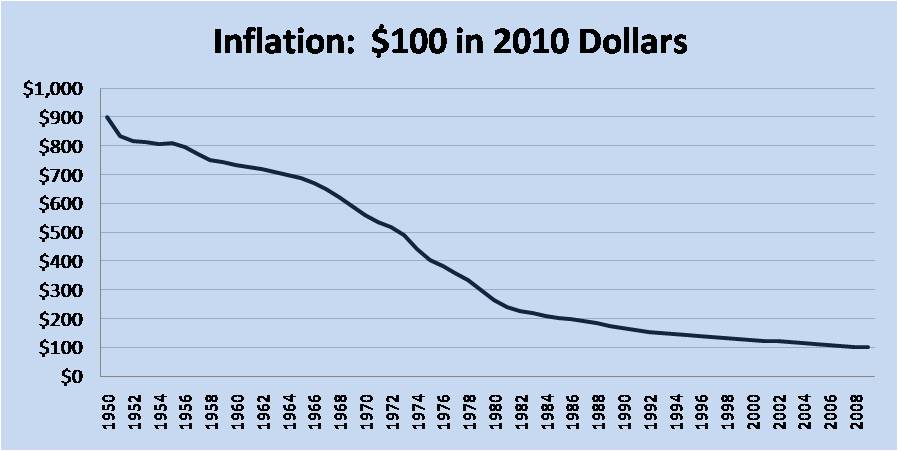

In looking at adding proof set information to the main web site, it seemed fun to look at what $100 in the proof set years of 1950 through 2009 would equate to in 2010 dollars. Well, it can be fun, and it can also be depressing. For the sake of every one’s mental health, we’ll think fun.

Side note, these numbers were generated using the Bureau of Labor Statistics inflation calculator.

Looking at 1950, it would take $899.34 in 2010 dollars to buy the same amount of goods and services as $100 did in 1950.

Scary, hunh?

If you invested $100 in 1950 at 3.68% interest compounded quarterly, the initial $100 would have grown to $900.61 over the last sixty years.

On a related note (since this analysis was thought of while adding proof set information to the web site), the 1950 Proof Set contained five coins, three of which were silver, for a face value of $0.91 and sold by the US Mint for $2.10.

In 2010 dollars, it would take $18.89 to equal that 1950 sales price of $2.10.

But, what would it take to buy a 1950 proof set today?

As recently as early April 2010, the asking price was $625. (Gentle reminder, this is the dealers’ sales price, not the price at which they would buy the set.)

Or, you could have invested that $2.10 in a 9.61% interest, compounded quarterly, account and have $626.26 today. Hmmm…was there even an interest bearing account that consistently performed at 9.61% interest over the years? Perhaps a few, but probably not very accessible for everyone as was the 1950 proof set.

But, where’s the fun in investing money in an interest account for numismatists?

Sitting in a bank or other financial investment vehicle does not provide the visual or tactile pleasure of the round, shiny coins. Neither does the financial investment peak the numismatist’s interest in history nor satisfy their sheer enjoyment of collecting.

“Sure,” you ask, “what about proof sets from the later years?”

Currently, several proof sets have fallen in price as compared to initial investments and inflation. But, that’s only bad news if you need to sell these proof sets to raise cash.

Instead, now would be an excellent time to buy these sets at the cheaper prices.