Yesterday, we talked about the production cost of the penny being greater than one cent, and how people are beginning to collect pennies for their metal content (even though it’s illegal to melt pennies – see 31 CFR Part 82).

Similarly, the production cost of the nickel exceeds five cents and has since 2006.

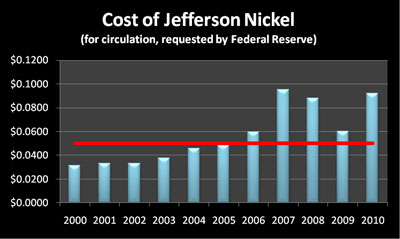

Take a look at this chart showing the per unit cost for the Mint’s fiscal years of 2000 through 2010. The red line shows the five cent mark on the chart, and though 2005 looks to be at the mark, it’s just under at 4.8 cents.

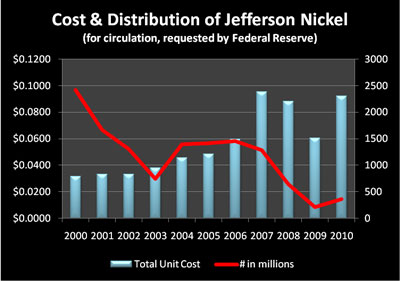

The next chart shows the unit cost by fiscal year along with the requests from the Federal Reserve Banks for the nickels (in millions).

It’s interesting to look through the annual reports through the years for the Mint’s commentary about the costs of the metals – in particular, nickel for this discussion.

From the 2006 Annual Report:

“During the fourth quarter of FY 2006, increases in the prices of zinc and nickel raised the costs of production for the one-cent and 5-cent coins above their face values.”

“Perhaps the greatest challenge facing the United States Mint is the increased cost of producing circulating coinage resulting from the dramatic increases in the prices of zinc, copper, and nickel. In fact, as of the end of FY 2006, the costs of producing one-cent and 5-cent coins were exceeding the face value of these coins.”

From the 2007 Annual Report

“High metal prices continued to have a significant effect on production costs, causing the one-cent and 5-cent denominations to cost more than their face values for the second fiscal year in a row.”

“Steady and dramatic increases in the prices of zinc, copper, and nickel have raised the cost of producing circulating coinage. This continues to cause the one-cent and 5-cent coins to cost more than their face values on a per-unit basis.”

From the 2008 Annual Report

“Steady increases in the prices of copper, nickel and zinc have driven up the cost of producing circulating coinage over the last few years. The average daily spot price for the month of September increased 122.5 percent for nickel between 2004 and 2007. In FY 2008, however, the market price of nickel and zinc fell from FY 2007 peaks. The average daily spot price for the month of September decreased 39.8 percent for nickel between 2007 and 2008.”

“Despite the recent decline in base metal prices, gross cost actually increased relative to the overall face value of coins shipped. When production volumes decline because of lower demand, fixed production costs are spread over fewer units. This offsets any per-unit gains from lower base metal costs. For example, the per-unit metal cost of a nickel fell about $0.0154 from $0.0815 in FY 2007 to $0.0661 in FY 2008. However, the per-unit fixed production costs increased $0.0082, resulting in only a small decline in the nickel overall unit cost.”

“While declining from last year, the unit cost for penny and nickel denominations remained above face value for the third consecutive fiscal year. Lower demand did reduce the overall loss the United States Mint incurred from producing these denominations. Penny and nickel coins were produced at a loss of $47.0 million, down from the FY 2007 loss of about $98.6 million.”

From the 2009 Annual Report

“While metal prices fell during the global recession, thus reducing our losses on pennies and nickels, base metal prices have begun to rise as the world economy begins to recover. “

“Weakened demand reduced both the gross cost and seigniorage from circulating operations. Circulating gross costs fell to $349.8 million in FY 2009 from $588.3 million in FY 2008. Market prices of copper, nickel and zinc fell to five-year lows in the beginning of FY 2009. The average daily spot price for nickel declined 49.3 percent from FY 2008 to FY 2009.”

“Slight increases in per-unit production and SG&A costs did not offset the 3.1 cent decline in the five-cent coin’s per-unit metal cost. Accordingly, the five-cent coin’s total unit cost declined 2.8 cents from FY 2008. Despite this, the unit cost for both one-cent and five-cent denominations remained above face value for the fourth consecutive fiscal year. Low demand for the five-cent coin largely reduced the overall loss the United States Mint incurred from producing these denominations in FY 2009. One-cent and five-cent coins were produced at a loss of $22.0 million, down 53.2 percent from the FY 2008 loss of about $47.0 million.”

“While metal prices fell from prior peaks in FY 2009, base metal expenses continue to make up the largest portion of circulating production cost. Toward the end of FY 2009, market prices for copper, nickel and zinc all started to increase to FY 2007 levels. “

From the 2010 Annual Report

“Circulating coin shipments increased 3.7 percent to 5,399 million coins in FY 2010. While the total volume grew, the composition of shipments shifted toward lower denomination coins, reducing their total value. The penny, nickel and dime made up 87.7 percent of total shipments, compared to 72.7 percent in FY 2009.”

“Even with these measures, the costs of coin production continued to increase because of escalating metal market prices. In FY 2010, market prices for copper, nickel and zinc climbed from five-year lows of FY 2009 to levels almost as high as those experienced in FY 2007. This increased expenses for fabricated blanks and strip for circulating coin production and raised unit costs for all denominations.”

“Market prices of copper, nickel and zinc recovered from FY 2009 lows and climbed back to prior fiscal year levels. The average daily spot price for nickel rose 55.8 percent from FY 2009 to FY 2010.”

“Per-unit metal costs increased in FY 2010, driving up the total unit cost of all denominations from last year. The nickel per-unit metal and fabrication cost rose 2.3 cents from FY 2009, increasing the nickel total unit cost 52.9 percent to 9.2 cents in FY 2010.”

“The unit cost for both penny and nickel denominations remained above face value for the fifth consecutive fiscal year. Higher unit cost and demand for the five-cent coin increased the overall loss the United States Mint incurred from producing these denominations in FY 2010. Penny and nickel coins were produced at a loss of $42.6 million, nearly double the FY 2009 loss of $22.0 million.”

Did you catch the “low demand” comment about the 2009 nickels?

Now the chart above shows a drop in FY2009’s distribution to the Federal Reserve Banks to a level of 207 million five-cent coins. But, remember, that chart shows the quantities for the fiscal year.

Looking at the US Mint’s production numbers for calendar year 2009, the nickel quantities are even more interesting. For January through December 2009, the Denver Mint produced 46.8 million and Philadelphia produced 39.84 million for a total of 86.64 million nickels for circulation.

Could the nickel coin become valuable not only for its metal content but also for its low mintages – especially the 2009?