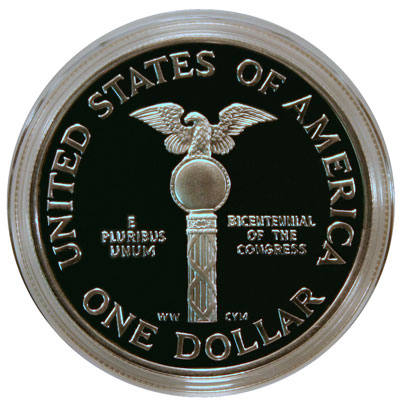

It’s fitting to view the reverse of the 1989 United States Congress dollar when discussing taxes. The reverse of the dollar shows the mace of the House of Representatives. All spending and budgetary items originate in the house.

For today’s tax discussion, let’s review the meanings of “revenue neutral taxes,” “revenue neutral policy” and “neutral taxes.” We will utilize multiple resources on the internet to help with the definitions.

Revenue Neutral Tax – definition 1:

The term Revenue Neutral implies changes in the tax laws that result in no change in the amount of revenue coming into the government’s coffers. In other words, a tax proposal is revenue neutral if it neither increases nor decreases tax revenues when compared to existing law. For instance, a revenue neutral provision may require individuals to pay less tax, but corporations will pay correspondingly more taxes. The concept was the decisive factor in drafting the Tax Reform Act of 1986 “whereby provisions estimated to add revenue were offset by others estimated to reduce revenue, so that on paper the new bill would generate the same amount of revenue as the old tax laws.”

Revenue Neutral Tax – definition 2:

guiding criterion in drafting the tax reform act of 1986 whereby provisions estimated to add revenue were offset by others estimated to reduce revenue, so that on paper the new bill would generate the same amount of revenue as the old tax laws. The concept, which has guided subsequent tax legislation, was theoretical rather than real, since estimates are subject to variation.

Revenue Neutral Tax – definition 3:

A change in the tax code such that the amount of tax revenues that will be collected by government remains unchanged. For example, a decrease in marginal tax rates is accompanied by an elimination of certain deductions.

Revenue Neutral Tax – definition 4:

Guiding criterion in drafting the Tax Reform Act of 1986 whereby provisions estimated to add revenue were offset by others estimated to reduce revenue, so that on paper the new bill would generate the same amount of revenue as the old tax laws. The concept, which has guided subsequent tax legislation, was theoretical rather than real, since estimates are subject to variation.

Revenue Neutral Tax – definition 5:

Taxing procedure that allows the government to still receive the same amount of money despite changes in tax laws. The government may lower taxes for one particular group of people, but raise taxes for another group. This allows the revenue that they receive to remain unchanged (neutral).

Revenue Neutral Policy – definition:

A policy which has no effect on overall government revenue

Neutral Tax – definition 1:

Tax that does not cause individuals or firms to shift their economic choices, such as to choose among different goods, inputs, locations, etc.

Neutral Tax – definition 2:

A neutral tax is one that does not interfere with the economic behavior of individuals or firms. Compared .to the situation that would exist if no tax is imposed, a neutral tax would not interfere with the decisions of individuals to work or not work, to save or consume, or to consume one good or another; or with the decisions of firms on what to produce and what production methods to use. A cigarette tax, for example, is not neutral because it may discourage consumers from buying cigarettes. While some taxes are intended to change consumer behavior, neutrality is generally viewed as a desirable objective of tax policy because it is assumed that both the value of economic production and consumer satisfaction will decline if a tax forces either firms or individuals to change their behavior.

These definitions are important when discussing the potential for sales taxes to apply to coins, currency and bullion since some people call these sales taxes “revenue neutral.”

By working closely with numismatic groups and dealers, ICTA has helped 29 states prove that sales tax on coins, currency and bullion changes people’s buying patterns and forces business out of the state. ICTA is the Industry Council for Tangible Assets which is a national trade association for the rare coin, precious metals and tangible assets industry.

With their supporting information, ICTA helped show that a sales tax on coins, currency and bullion is not a Neutral Tax in that it DOES change consumer buying habits and it DOES force businesses to shut their doors or move out of state.

A sales tax is also not a Revenue Neutral Tax. The state legislature’s objective is to increase the state’s coffers. They would not decrease another tax to keep the tax revenue consistent.

But, ICTA’s efforts did show that a sales tax on coins, currency and bullion had negligible impact to overall state sales tax revenue by virtue of forcing the business elsewhere.

Therefore, at best, adding sales tax to coins, currency and bullion would be a Revenue Neutral Policy in that the state government’s revenue would not increase.

Your Georgia state representative needs to hear from each of you collectors and investors. Each legislator needs to understand revoking the sales tax exemption on coins, currency and bullion would not achieve their desired result of increased revenue.